Entrepreneurs can’t avoid risk, but they must mitigate it.

When you leave your job to open a business, you take a big risk. Maybe you do some research, or maybe you just go with your gut.

Every decision you make after that first one compounds your risk.

When you make decisions without data or perspective, your business becomes shakier and shakier.

And without a solid foundation, you won’t survive many bad guesses.

Removing the Guesswork

Mentors provide perspective. Mentors provide experience. And with the new Two-Brain Dashboard, you can actually test out your decisions before you make them!

You don’t have to guess anymore.

For example, if you’re getting new clients but still feel overworked, you might decide it’s time to hire a general manager. But this is your first salaried hire—can you afford it? Will you exceed your salary cap?

Here’s the exercise that will help you mitigate the risk:

If you’re in the Two-Brain Family, open your Two-Brain Dashboard.

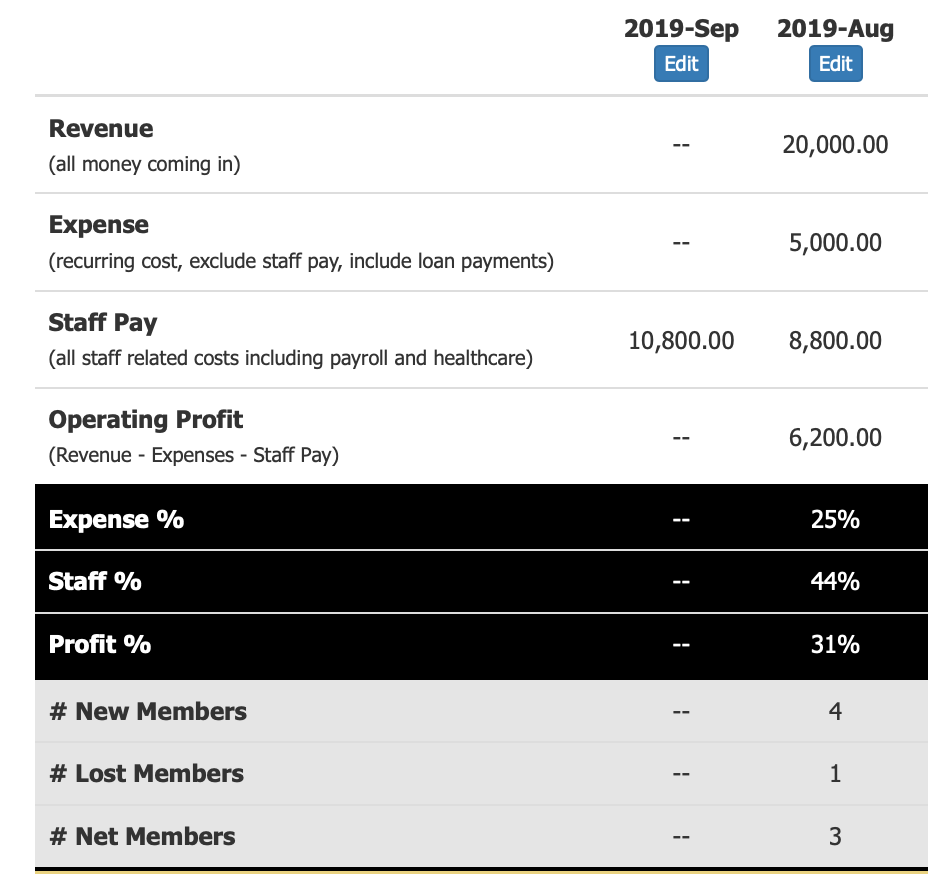

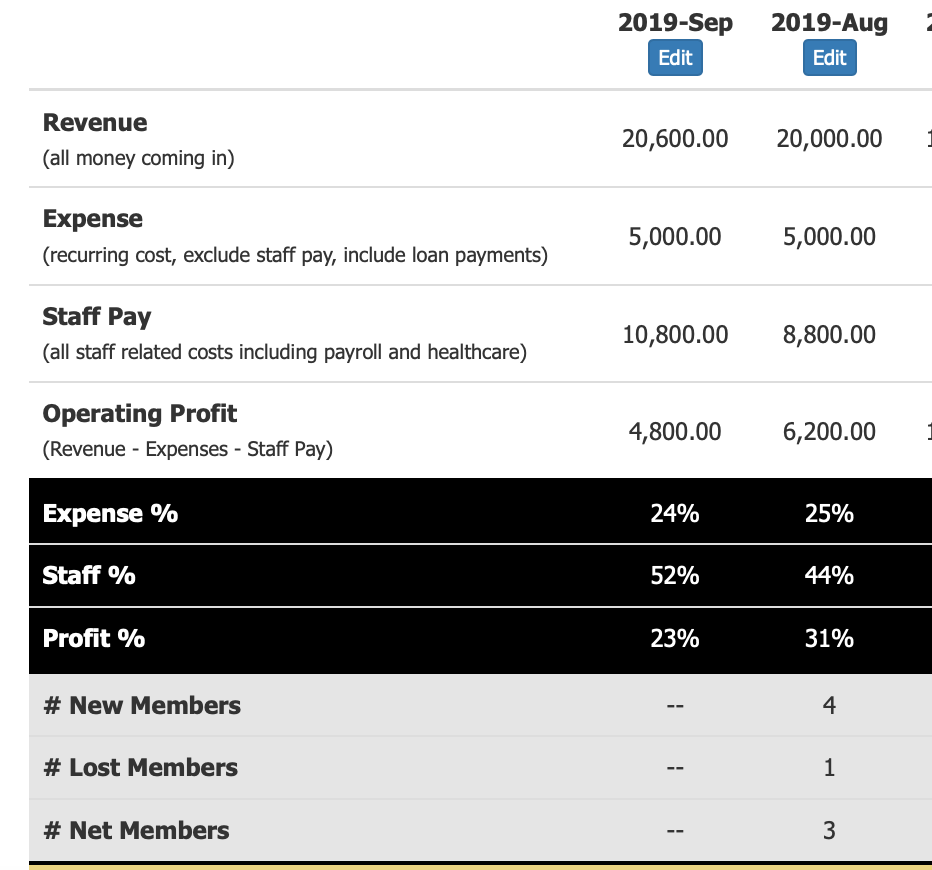

First, add the cost of the new staff person into a future month. In this example, I added $2,000 to September 2019’s Staff Pay because the only change will be a new hire for $2,000.

Next, add the revenues created by the new role. Be conservative, but remember this: Every staff person should create at least 2.5 times the revenue required to pay him or her. This rule even applies to the cleaner, because you’ll be working on sales and marketing while the cleaner mops.

In this example, the new staff person will launch a Two-Brain Kids program, with expected revenues conservatively estimated at $600 per month.

Add your other expenses as if they’ll be the same because we’re only measuring one variable (the new hire):

Obviously, our Operating Profit is down by $1,400, and our Staff Percentage is out of whack, which brings our Profit Percentage down. But this sample company is still in the black, so it should take the next step: a test.

“Pay” that difference into an account for three months. What happens when that money is removed from your system?

Can you afford the hire?

This new hire should allow you to grow the business—if you know where to spend your time. Right? Plan that with your mentor.

But if the expense hurts more than you thought, or if you’re not sure how to spend the time you save, go back to the drawing board.

Can you split up the role any differently?

Can you hire a part-time person for now?

Can you figure out other work for the person to do to generate revenues?

Don’t Guess—Know

There are never situations where you have to make a decision in less than three months. If a huge opportunity shows up and requires a decision tomorrow, then the decision is made: “Can’t do it right now.”

The bigger your business, the more rides on every decision you make. That means you need better tools than a clean napkin and a pen or a pros and cons list.

You need to know.

And using the Two-Brain Dashboard makes the choice crystal clear.

Need more advice on common problems? Click here to book a free call with a certified Two-Brain Business mentor.